Binance Shifts $1 Billion User Protection Fund to Bitcoin Amidst Market Turmoil, Pledges Regular Audits

Binance Fortifies User Protection with Strategic Bitcoin Conversion

In a significant move to bolster its Secure Asset Fund for Users (SAFU), global cryptocurrency exchange Binance has announced its decision to convert the entirety of its $1 billion stablecoin holdings within the fund into Bitcoin. This strategic shift, slated to occur over the next 30 days, comes amidst prevailing market volatility and aims to reinforce user protection by leveraging Bitcoin's long-term growth potential and perceived resilience.

Established in 2018, the SAFU fund serves as an emergency insurance fund designed to protect Binance users in extreme cases of security breaches or unforeseen market events. Historically, the fund has maintained a diverse portfolio, including stablecoins like BUSD and USDT, alongside Bitcoin and Binance Coin (BNB). The latest directive, confirmed by Binance CEO Changpeng Zhao, signifies a pivot towards a single, dominant cryptocurrency asset for the fund's stablecoin portion.

Rationale Behind the Bitcoin Mandate

Binance's rationale for this conversion is multifaceted. While stablecoins offer price stability against fiat currencies, their value proposition is inherently linked to the stability of the underlying assets they represent. In contrast, Bitcoin, despite its price fluctuations, is increasingly viewed as a store of value and a hedge against broader economic uncertainties, often outperforming other assets during periods of market distress.

By migrating the stablecoin component of SAFU into Bitcoin, Binance appears to be signaling a long-term conviction in Bitcoin's appreciation and its capacity to provide robust financial backing for user assets, even during prolonged market downturns. The exchange has committed to regular audits of the fund, ensuring transparency and accountability regarding its composition and valuation, which will be accessible to the public.

Implications for User Confidence and Market Dynamics

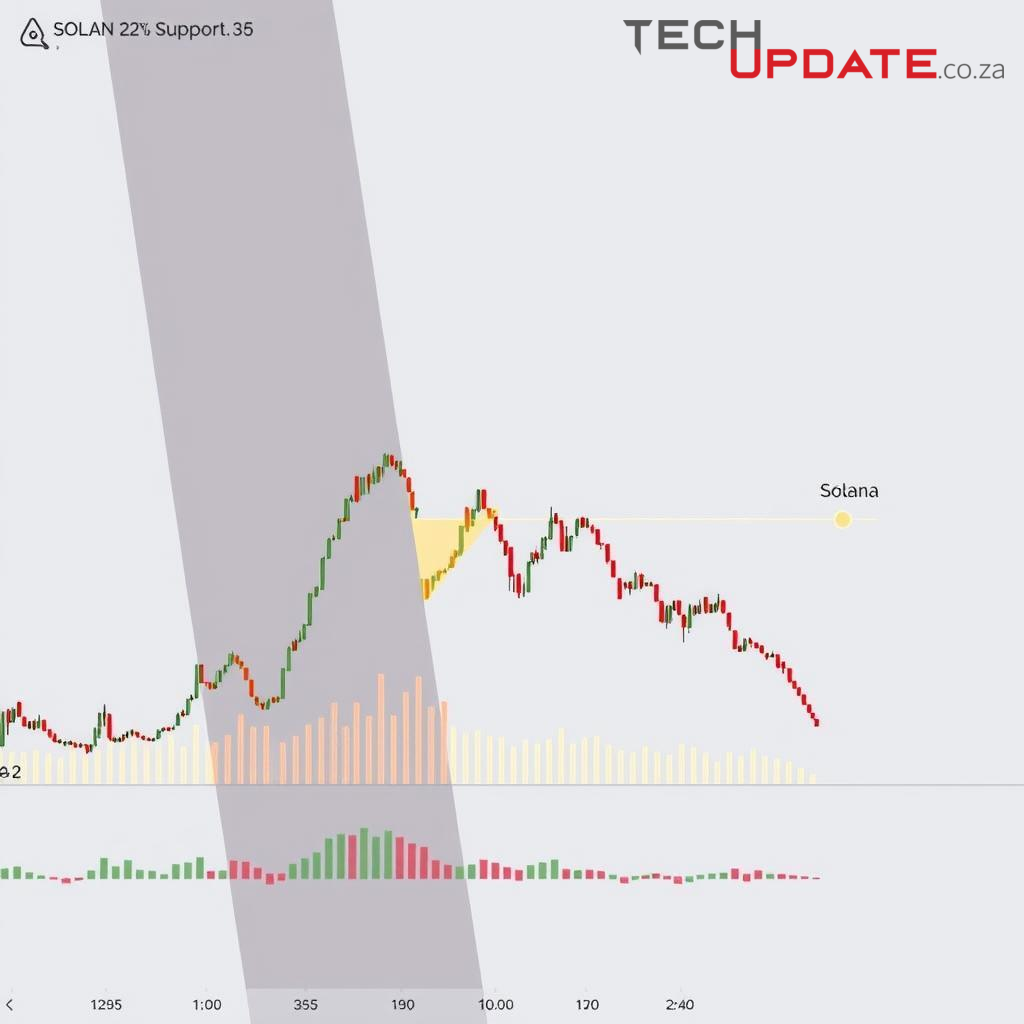

This bold move by Binance is likely to be scrutinized by both market participants and regulators. For users, the conversion could be interpreted as a strong vote of confidence in Bitcoin's future, potentially alleviating concerns about the fund's ability to cover substantial losses during a severe market rout. However, it also introduces increased volatility into the fund's valuation, as Bitcoin's price swings directly impact the fund's dollar equivalent.

From a broader market perspective, a $1 billion acquisition of Bitcoin, even if executed gradually over a month, represents a significant inflow into the world's largest cryptocurrency. While unlikely to cause dramatic short-term price spikes, it underscores institutional confidence and could contribute to a bullish sentiment, particularly if other major platforms follow suit or if the move is seen as a de-facto endorsement of Bitcoin as a primary reserve asset.

Summary

Binance's decision to convert its $1 billion SAFU stablecoin holdings into Bitcoin marks a pivotal strategic shift aimed at enhancing user protection through a robust, long-term asset. This move reflects a deep conviction in Bitcoin's potential, despite its inherent volatility, and reinforces the exchange's commitment to transparency through regular audits. The implications for user confidence and the broader crypto market are substantial, potentially setting a new precedent for how major exchanges manage their emergency reserves.

Resources

- Binance Official Announcement (e.g., Binance Blog or X/Twitter official account)

- CoinDesk

- The Block Crypto

Details

Author

Top articles

You can now watch HBO Max for $10

Latest articles

You can now watch HBO Max for $10

Binance Fortifies User Protection with Strategic Bitcoin Conversion

In a significant move to bolster its Secure Asset Fund for Users (SAFU), global cryptocurrency exchange Binance has announced its decision to convert the entirety of its $1 billion stablecoin holdings within the fund into Bitcoin. This strategic shift, slated to occur over the next 30 days, comes amidst prevailing market volatility and aims to reinforce user protection by leveraging Bitcoin's long-term growth potential and perceived resilience.

Established in 2018, the SAFU fund serves as an emergency insurance fund designed to protect Binance users in extreme cases of security breaches or unforeseen market events. Historically, the fund has maintained a diverse portfolio, including stablecoins like BUSD and USDT, alongside Bitcoin and Binance Coin (BNB). The latest directive, confirmed by Binance CEO Changpeng Zhao, signifies a pivot towards a single, dominant cryptocurrency asset for the fund's stablecoin portion.

Rationale Behind the Bitcoin Mandate

Binance's rationale for this conversion is multifaceted. While stablecoins offer price stability against fiat currencies, their value proposition is inherently linked to the stability of the underlying assets they represent. In contrast, Bitcoin, despite its price fluctuations, is increasingly viewed as a store of value and a hedge against broader economic uncertainties, often outperforming other assets during periods of market distress.

By migrating the stablecoin component of SAFU into Bitcoin, Binance appears to be signaling a long-term conviction in Bitcoin's appreciation and its capacity to provide robust financial backing for user assets, even during prolonged market downturns. The exchange has committed to regular audits of the fund, ensuring transparency and accountability regarding its composition and valuation, which will be accessible to the public.

Implications for User Confidence and Market Dynamics

This bold move by Binance is likely to be scrutinized by both market participants and regulators. For users, the conversion could be interpreted as a strong vote of confidence in Bitcoin's future, potentially alleviating concerns about the fund's ability to cover substantial losses during a severe market rout. However, it also introduces increased volatility into the fund's valuation, as Bitcoin's price swings directly impact the fund's dollar equivalent.

From a broader market perspective, a $1 billion acquisition of Bitcoin, even if executed gradually over a month, represents a significant inflow into the world's largest cryptocurrency. While unlikely to cause dramatic short-term price spikes, it underscores institutional confidence and could contribute to a bullish sentiment, particularly if other major platforms follow suit or if the move is seen as a de-facto endorsement of Bitcoin as a primary reserve asset.

Summary

Binance's decision to convert its $1 billion SAFU stablecoin holdings into Bitcoin marks a pivotal strategic shift aimed at enhancing user protection through a robust, long-term asset. This move reflects a deep conviction in Bitcoin's potential, despite its inherent volatility, and reinforces the exchange's commitment to transparency through regular audits. The implications for user confidence and the broader crypto market are substantial, potentially setting a new precedent for how major exchanges manage their emergency reserves.

Resources

- Binance Official Announcement (e.g., Binance Blog or X/Twitter official account)

- CoinDesk

- The Block Crypto

Top articles

You can now watch HBO Max for $10

Latest articles

You can now watch HBO Max for $10

Similar posts

This is a page that only logged-in people can visit. Don't you feel special? Try clicking on a button below to do some things you can't do when you're logged out.

Example modal

At your leisure, please peruse this excerpt from a whale of a tale.

Chapter 1: Loomings.

Call me Ishmael. Some years ago—never mind how long precisely—having little or no money in my purse, and nothing particular to interest me on shore, I thought I would sail about a little and see the watery part of the world. It is a way I have of driving off the spleen and regulating the circulation. Whenever I find myself growing grim about the mouth; whenever it is a damp, drizzly November in my soul; whenever I find myself involuntarily pausing before coffin warehouses, and bringing up the rear of every funeral I meet; and especially whenever my hypos get such an upper hand of me, that it requires a strong moral principle to prevent me from deliberately stepping into the street, and methodically knocking people's hats off—then, I account it high time to get to sea as soon as I can. This is my substitute for pistol and ball. With a philosophical flourish Cato throws himself upon his sword; I quietly take to the ship. There is nothing surprising in this. If they but knew it, almost all men in their degree, some time or other, cherish very nearly the same feelings towards the ocean with me.

Comment